Collecting real estate taxes is crucial for Orangeburg South Carolina. These real estate property taxes fund vital local services like Orangeburg public education, Orangeburg police, and Orangeburg emergency medical care. Delinquent taxes create cash-flow problems, hindering Orangeburg County South Carolina's ability to provide these essential services to residents.

Without the tax revenue generated from real estate located in Orangeburg South Carolina then Orangeburg County South Carolina would literally go bankrupt.

To solve this cash-flow problem, the tax collector advertises the Orangeburg County South Carolina tax sale date. At the scheduled time, Orangeburg County South Carolina auctions South Carolina tax liens to winning bidders at the Orangeburg County South Carolina tax lien sale.

In return, Orangeburg County South Carolina gives investors South Carolina tax lien certificates. A tax lien certificate is a document indicating ownership of a real estate tax lien. A tax lien is simply a claim for taxes.

The sale of an South Carolina tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Orangeburg County South Carolina to the investor.

When purchasers buy tax lien certificates in South Carolina, they are paying someone else's delinquent property taxes. What's more, South Carolina actually gives purchasers the right to receive all of the tax money due - including fees, interest, and/or penalties.

To encourage tax delinquent owners to pay their past-due property taxes, the state of South Carolina charges interest on the amount paid to satisfy the delinquent taxes, which is passed directly to the tax lien certificate purchaser.

The sale of tax lien certificates is a solution to a complex problem Orangeburg County South Carolina recovers lost revenue needed to fund local services, the property owner gets more time to satisfy their delinquent property tax bill and the purchaser receives a tax lien certificate which is real estate secured and offers interest mandated by South Carolina law.

For "risk-sensitive" investors South Carolina tax lien certificates are an attractive alternative to traditional investments choices. With tax lien certificates, purchasers are investing their money with Orangeburg County South Carolina and when the Orangeburg County South Carolina Tax Collector collects the past due taxes, they send purchasers a check, returning what they paid to purchase the South Carolina tax lien certificate plus applicable penalties, interest, and/or late fees.

South Carolina tax lien certificates are attractive in several ways. First, the rise and fall of interest rates has no effect on South Carolina tax lien certificates. Unlike the stock market, interest rates on South Carolina tax lien certificates are mandated by South Carolina law.

In addition, South Carolina tax lien certificates are secured by real estate. So if purchasers do not receive what they paid to purchase the South Carolina tax lien certificate plus interest and/or penalties within the law mandated redemption period, the purchaser acquires title to the property free and clear of all liens created prior to the sale.

So in review, there are generally two outcomes with the purchase of a tax lien certificate; the purchaser will either receive what was paid to satisfy the delinquent property taxes PLUS interest, or Orangeburg County South Carolina has the legal right to transfer them the property - often with no mortgage!

Once they own the property they can do whatever they like; sell it, rent it for monthly cash-flow, even move in (often with no mortgage payment).

Generally, people buy South Carolina tax lien certificates for several reasons:

IMPORTANT: As with any investment, there is always an element of risk. Even if the tax sale process is written into South Carolina law, mandated by South Carolina law, and regulated by South Carolina law, there is still a chance of purchasers incurring substantial loss. It is recommended that anyone considering buying a tax lien or tax foreclosure property consult properly licensed legal and accounting professionals.

Below you will find a collection of the latest user questions and comments relating to Tax Lien Certificates on tax-delinquent property located in Orangeburg South Carolina.

The following is a list of cities and towns located in Orangeburg County South Carolina. Tax Lien Certificates for properties located in the following cities are sold at the Orangeburg County South Carolina tax sale.

| Town/City: | Population: |

|---|---|

| Bolen Town, SC | 33,141 |

| Bowman, SC | 4,141 |

| Bowyer, SC | 6,084 |

| Branchville, SC | 2,670 |

| Cope, SC | 2,493 |

| Cordova, SC | 3,767 |

| Elloree, SC | 3,700 |

| Eutaw Springs, SC | 4,898 |

| Eutawville, SC | 4,898 |

| Felderville, SC | 3,700 |

| Holly Hill, SC | 6,084 |

| Jamison, SC | 33,141 |

| Livingston, SC | 3,003 |

| Neeses, SC | 3,003 |

| North, SC | 4,673 |

| Norway, SC | 1,683 |

| Orangeburg, SC | 46,738 |

| Parlers, SC | 4,648 |

| Pecan Way Terrace, SC | 33,141 |

| Rowesville, SC | 1,049 |

| Santee, SC | 4,648 |

| Springfield, SC | 1,963 |

| Vance, SC | 2,064 |

The following is a list of counties located in the state of South Carolina. Tax Lien Certificates for properties located in the following counties are sold at South Carolina county tax sales.

| County / Municipality: | Population: |

|---|---|

| Abbeville County, SC | 26,167 |

| Aiken County, SC | 142,552 |

| Allendale County, SC | 11,211 |

| Anderson County, SC | 165,740 |

| Bamberg County, SC | 16,658 |

| Barnwell County, SC | 23,478 |

| Beaufort County, SC | 120,937 |

| Berkeley County, SC | 142,651 |

| Calhoun County, SC | 15,185 |

| Charleston County, SC | 309,969 |

| Cherokee County, SC | 52,537 |

| Chester County, SC | 34,068 |

| Chesterfield County, SC | 42,768 |

| Clarendon County, SC | 32,502 |

| Colleton County, SC | 38,264 |

| Darlington County, SC | 67,394 |

| Dillon County, SC | 30,722 |

| Dorchester County, SC | 96,413 |

| Edgefield County, SC | 24,595 |

| Fairfield County, SC | 23,454 |

| Florence County, SC | 125,761 |

| Georgetown County, SC | 55,797 |

| Greenville County, SC | 379,616 |

| Greenwood County, SC | 66,271 |

| Hampton County, SC | 21,386 |

| Horry County, SC | 196,629 |

| Jasper County, SC | 20,678 |

| Kershaw County, SC | 52,647 |

| Lancaster County, SC | 61,351 |

| Laurens County, SC | 69,567 |

| Lee County, SC | 20,119 |

| Lexington County, SC | 216,014 |

| Marion County, SC | 35,466 |

| Marlboro County, SC | 28,818 |

| Mccormick County, SC | 9,958 |

| Newberry County, SC | 36,108 |

| Oconee County, SC | 66,215 |

| Orangeburg County, SC | 91,582 |

| Pickens County, SC | 110,757 |

| Richland County, SC | 320,677 |

| Saluda County, SC | 19,181 |

| Spartanburg County, SC | 253,791 |

| Sumter County, SC | 104,646 |

| Union County, SC | 29,881 |

| Williamsburg County, SC | 37,217 |

| York County, SC | 164,614 |

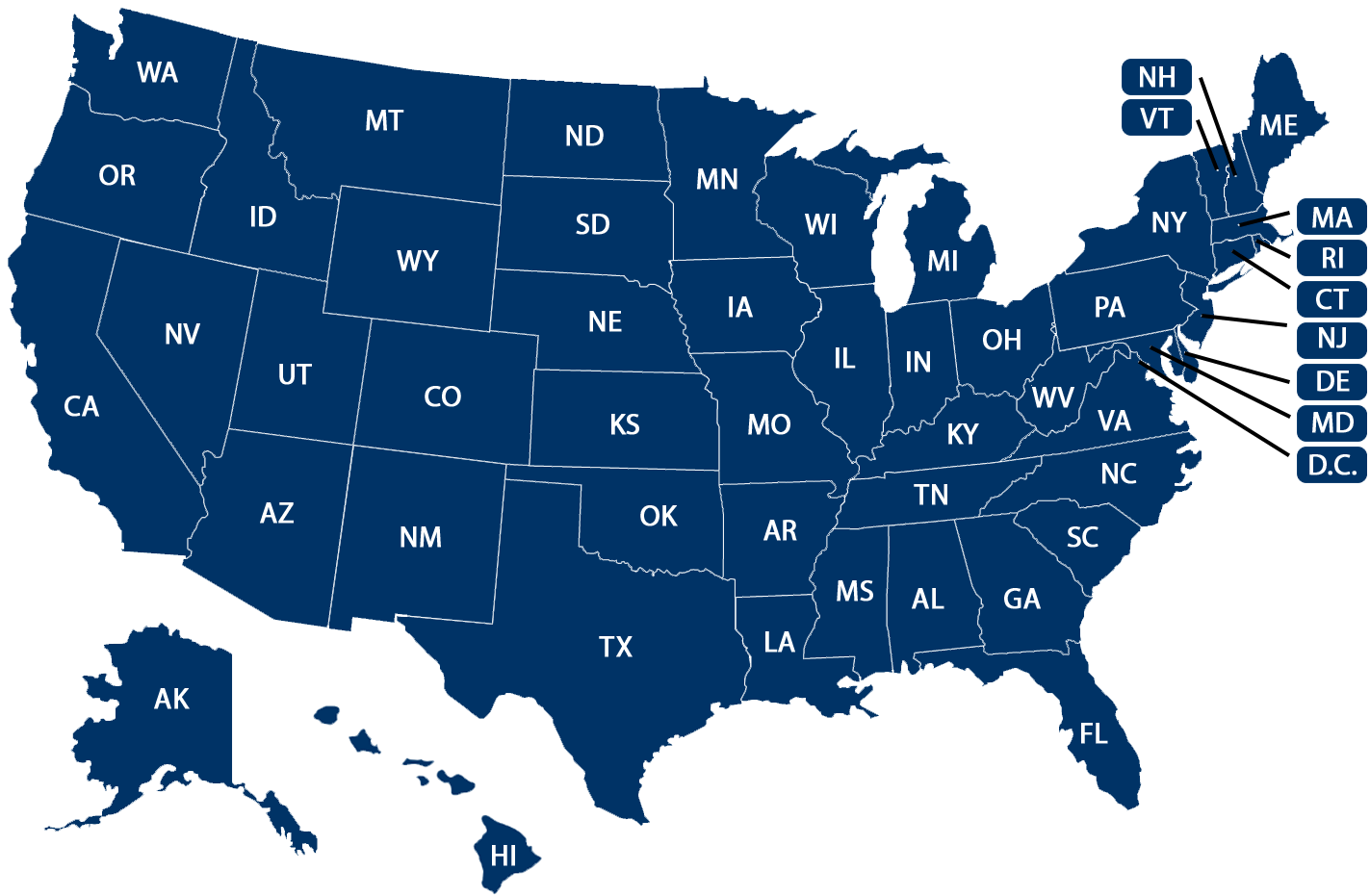

Learn more about each State's individual delinquent tax sale process for tax lien certificates, tax deeds and tax foreclosures by clicking on the name of the state for which you are interested from the list below:

| State: | Population: |

|---|---|

| Alabama | 5,108,468 |

| Alaska | 733,406 |

| Arizona | 7,431,344 |

| Arkansas | 3,067,732 |

| California | 38,965,193 |

| Colorado | 5,877,610 |

| Connecticut | 3,617,176 |

| Delaware | 1,031,890 |

| Florida | 22,610,726 |

| Georgia | 11,029,227 |

| Hawaii | 1,435,138 |

| Idaho | 1,964,726 |

| Illinois | 12,549,689 |

| Indiana | 6,862,199 |

| Iowa | 3,207,004 |

| Kansas | 2,940,546 |

| Kentucky | 4,526,154 |

| Louisiana | 4,573,749 |

| Maine | 1,395,722 |

| Maryland | 6,180,253 |

| Massachusetts | 7,001,399 |

| Michigan | 10,037,261 |

| Minnesota | 5,737,915 |

| Mississippi | 2,939,690 |

| Missouri | 6,196,156 |

| Montana | 1,132,812 |

| Nebraska | 1,978,379 |

| Nevada | 3,194,176 |

| New Hampshire | 1,402,054 |

| New Jersey | 9,290,841 |

| New Mexico | 2,114,371 |

| New York | 19,571,216 |

| North Carolina | 10,835,491 |

| North Dakota | 783,926 |

| Ohio | 11,785,935 |

| Oklahoma | 4,053,824 |

| Oregon | 4,233,358 |

| Pennsylvania | 12,961,683 |

| Rhode Island | 1,095,962 |

| South Carolina | 5,373,555 |

| South Dakota | 919,318 |

| Tennessee | 7,126,489 |

| Texas | 30,503,301 |

| Utah | 3,417,734 |

| Vermont | 647,464 |

| Virginia | 8,715,698 |

| Washington | 7,812,880 |

| West Virginia | 1,770,071 |

| Wisconsin | 5,910,955 |

| Wyoming | 584,057 |

Click map to research each states tax lien process for selling tax lien certificates and tax foreclosures.

![]()

What are liens?

![]()

What effect do liens have on title?

![]()

What is lien priority?

![]()

What are tax lien certificates?

![]()

What is the tax sale bidding process?

![]()

How do you buy tax lien certificates?

![]()

What happens to unsold tax liens?

![]()

Can you buy tax liens with a business?

![]()

What are tax sale overages?

![]()

How do you get a tax sale list?

![]()

Which states sell tax liens?

![]()

Which states sell tax deeds?

![]()

Which states sell hybrid tax deeds?

View articles answer questions on tax lien certificates, tax deeds, and more.

Tax Lien University, Inc 10102 S Redwood Rd

South Jordan, UT 84095

info [at] taxlienuniversity.com

sitemap

© 2024 by Tax Lien University, Inc. All rights reserved. Tax Lien University, Inc. and its subsidiary Creating Wealth Without Risk™, Inc. (The Company) does not guarantee income or success, and examples shown at TaxLienUniversity.com and CreatingWealthWithoutRisk.com do not represent an indication of future success or earnings. The Company declares all information shared is true and accurate, and any claims made of actual earnings or examples of actual results can be verified upon request.

We are required by the FTC to disclose the typical customer results. Quite honestly, the typical customer does not make any money whatsoever. In fact, the typical customer does not even finish the training videos. Less than 1 in 100 ever ask a question of our coaches, leave feedback or otherwise show they're putting in any focused effort at all. Like anything worthwhile, our educational products require work. The typical customer puts in very little work. Before you buy, you should stop and ask yourself if you're typical.

Offer valid in the US and Canada. Limit one (1) copy per household, must be 18 years of age or older. Upon submitting the form above you will be given the choice between a physical 4-Disc version or a digital download version. If you select the physical version the normal retail charge of $39.97 is waved however you will be charged a one-time USPS shipping and handling charge of $9.95. If you select the digital download version there will be no charge and you can immediately download the contents of your selection.

The earnings, revenue and profit results that a customer will generally achieve in circumstances similar to those depicted in the endorsements and testimonials on this site depend on many factors and conditions, including but not limited to, work ethic, learning ability, use of the products and services, business experience, daily practices, business opportunities, business connections, market conditions, availability of financing, and local competition, to name a few.

Because of impediments due to any one or more of the foregoing and other factors, it is generally expected that no earnings, revenues or profits will be achieved with the use of any products or services advertised on this site in circumstances similar to those referenced in any endorsement or testimonial.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Your use of this website constitutes acceptance of the disclosures, disclaimers, privacy policy, no spam policy, and terms of use.